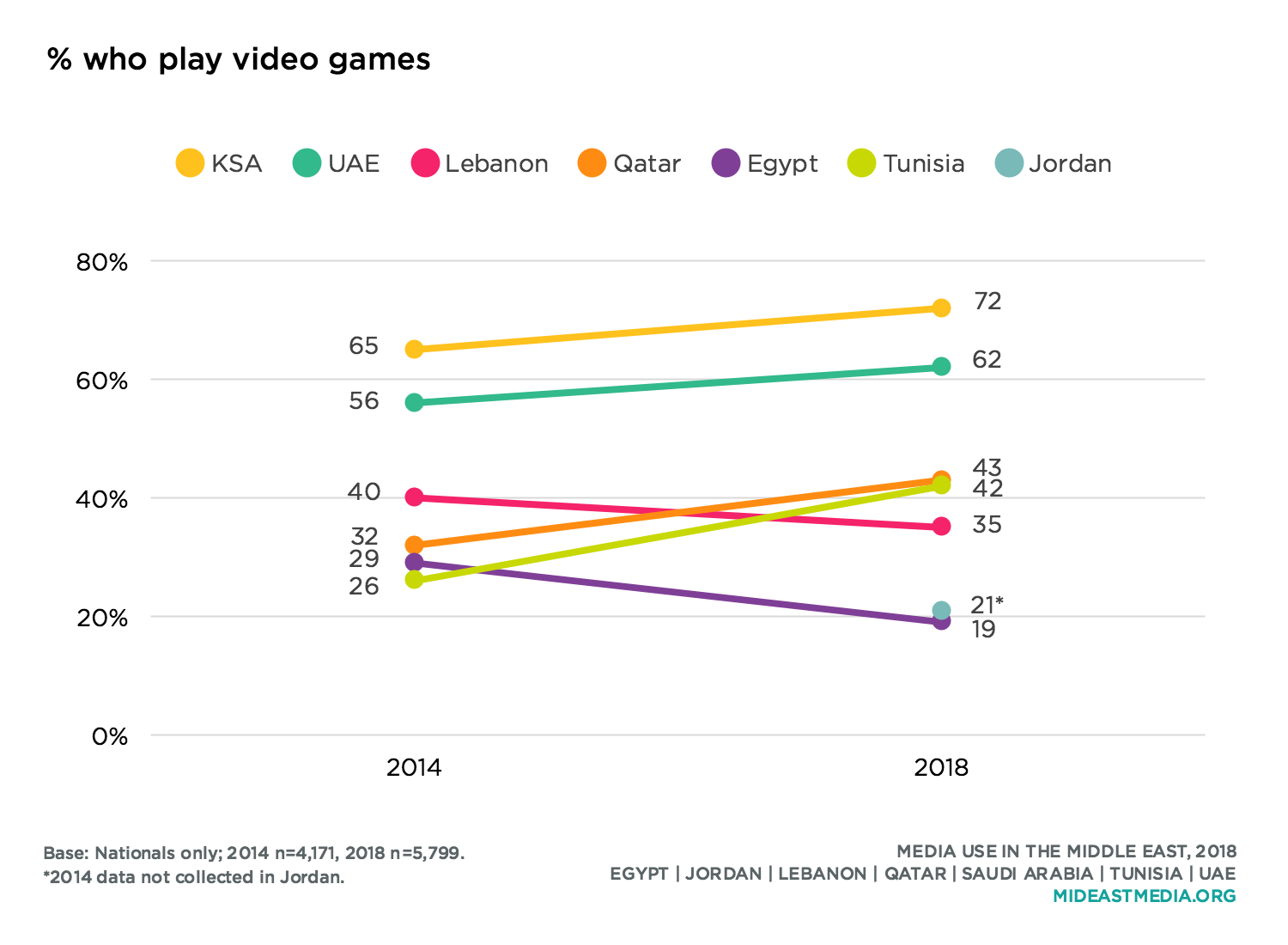

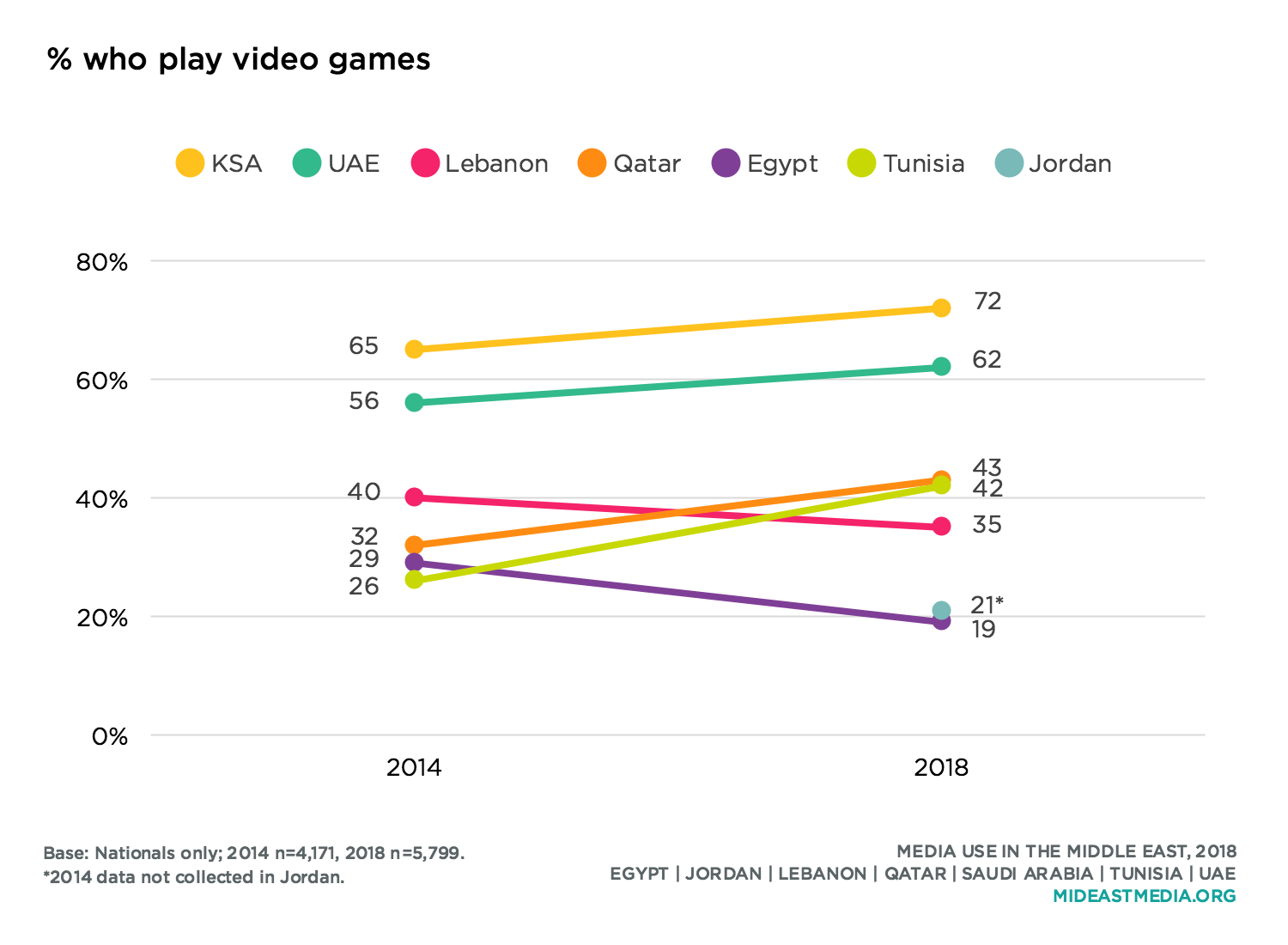

Video gaming among Arab nationals has remained consistent to that in 2014—four in 10 nationals play games—but varies widely by country. More Saudis and Emiratis than any other nationals play video games and Jordanians, Egyptians, and Lebanese are the least likely nationals to play.

Gaming varies by key demographics. Men are more likely to play video games than women, though three in 10 women also play (44% men vs. 31% women). More than half of the youngest nationals play video games, three times the rate of the oldest cohort (55% 18-24 year-olds, 45% 25-34 year-olds, 31% 35-44 year-olds, 16% 45+ year-olds). Similarly, the most educated nationals are four times as likely to play video games as those with a primary education or less (46% university or more, 43% secondary, 24% intermediate, 10% primary or less).

Given near-saturation levels of smartphone ownership in most Arab countries studied here—eight in 10 of all nationals own a smartphone—it is perhaps not surprising that over half of nationals play games on a phone at least occasionally, up from 44% as recently as 2016. Moreover, one-quarter of all nationals play on a phone daily. Majorities of nationals in all countries except Jordan and Egypt play games on a phone (86% UAE, 81% KSA, 53% Qatar, 53% Tunisia, 49% Lebanon, 38% Jordan, 37% Egypt).

A majority of men and nearly as many women play games on a phone (56% men, 48% women), but doing so differs across age and education categories. Seven in 10 of the youngest age group play games on a phone (39% play every day), compared to just one-fourth among the oldest nationals (71% 18-24 year-olds, 64% 25-34 year-olds, 45% 35-44 year-olds, 24% 45+ year-olds) and the likelihood of phone gaming increases with education (20% primary or less, 39% intermediate, 58% secondary, 60% university or more).

More nationals in 2018 than 2016 said their time spent playing console video games and games on a phone both increase during Ramadan.

Nationals who play video games spend about 12 hours each week doing so, up from about 10 hours per week in 2014. There is considerable variation across countries, and Lebanese gamers spend more time playing than other nationals, Egyptians the least (17 hours vs. 8 hours).

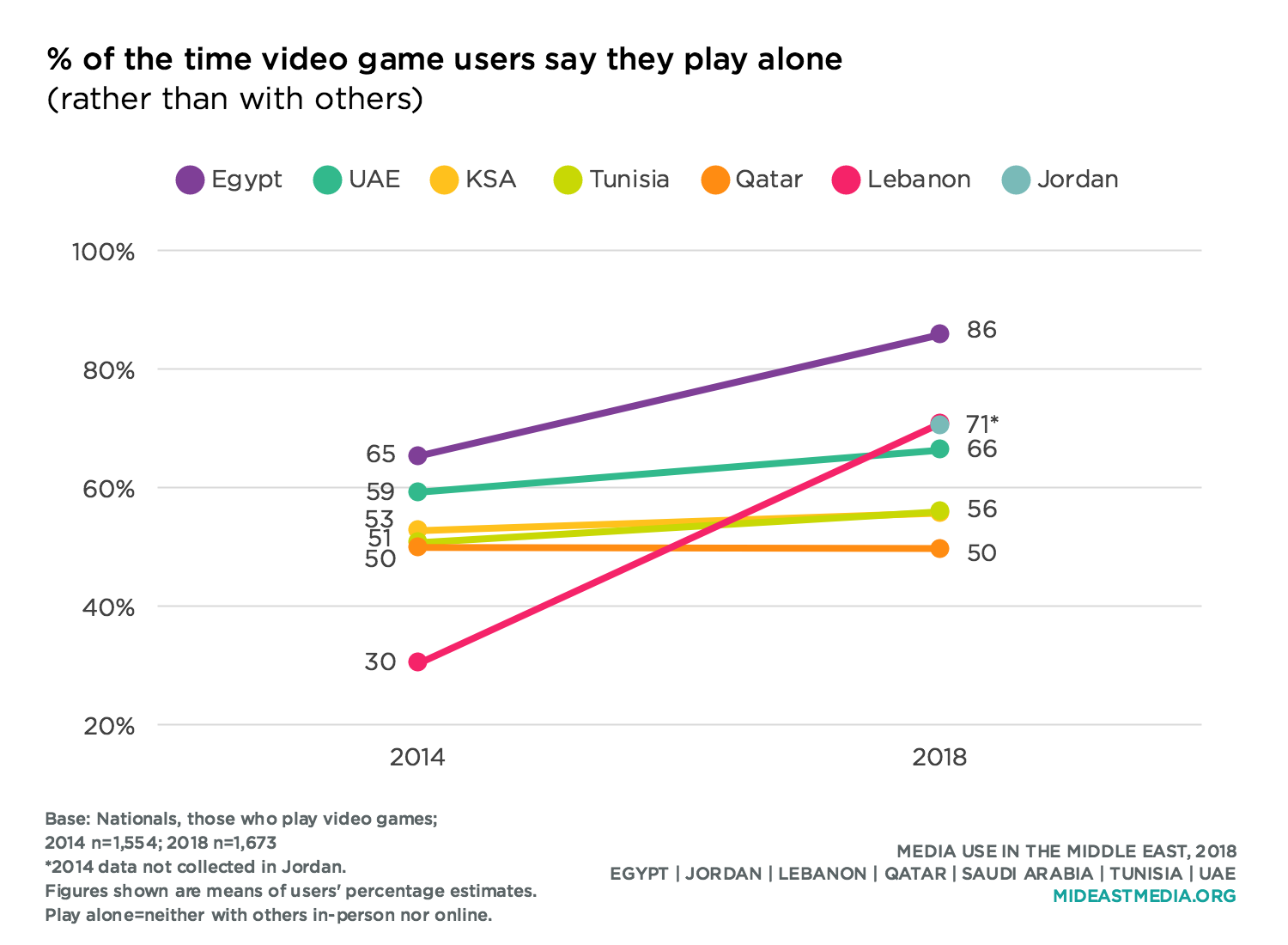

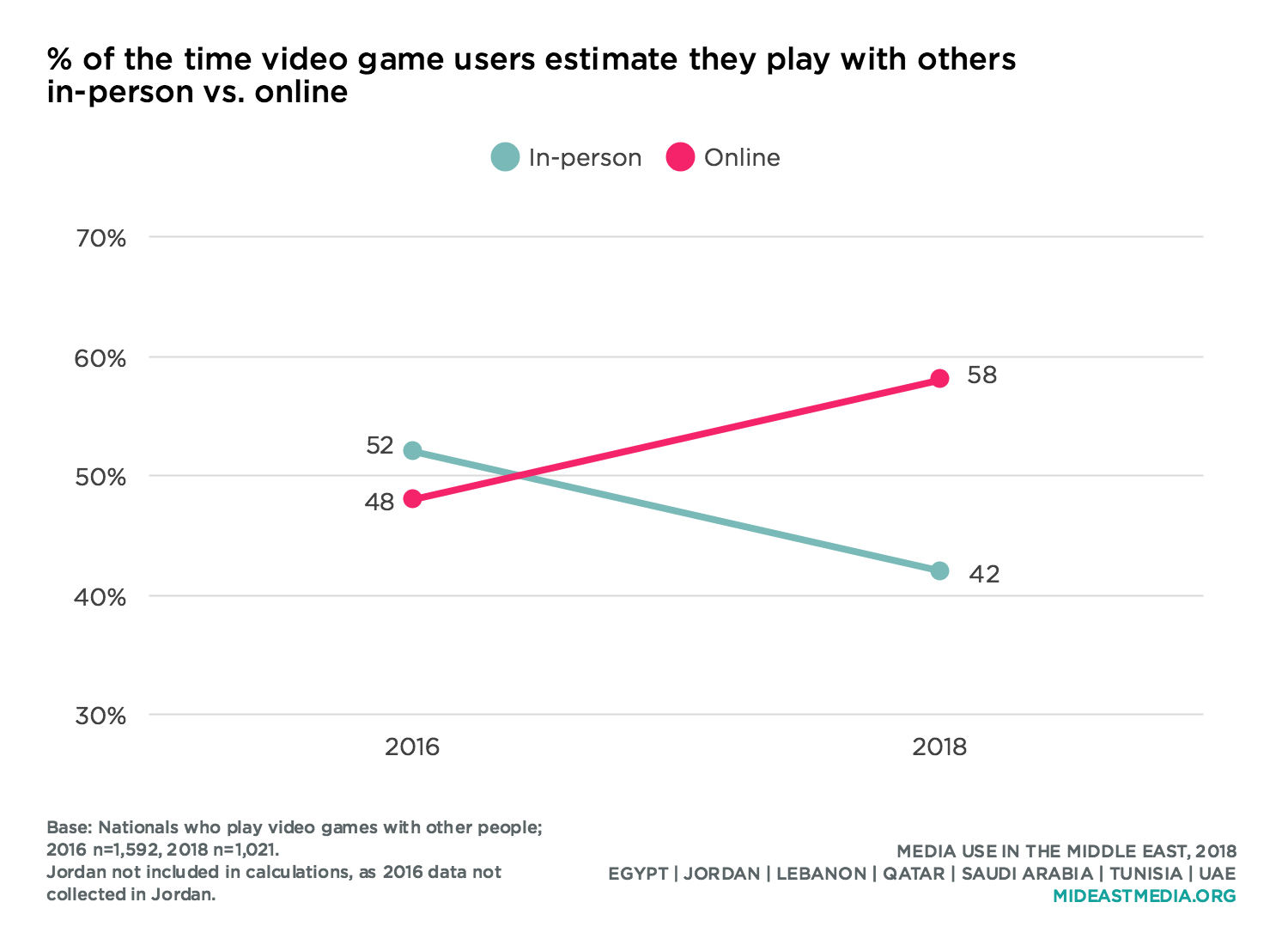

In Qatar, Saudi Arabia, and Tunisia, people are roughly as likely to play video games alone as they are to play with others, while those in Egypt, Jordan, Lebanon, and the UAE are more likely to say they play alone. In 2014 and 2016, the time spent playing video games with others was roughly equally split between online and in person. In 2018, gamers are more likely to play with others online than in person.

Women estimate that more of the time they spend playing video games is alone than with others, and the gap is greater than that among men (73% women vs. 64% men). Older gamers play alone more often than younger nationals (79% 45+ year-olds, 71% 35-44 year-olds, 69% 25-34 year-olds; 63% 18-24 year-olds). When playing video games with others, younger gamers spend a higher proportion of time doing so online (versus in person) than older respondents who play video games, but even the oldest nationals estimate that half of their time playing with other people is online (time playing with others is online: 62% 18-24 year-olds, 59% 25-34 year-olds, 52% 35-44 year-olds, 53% 45+ year-olds).

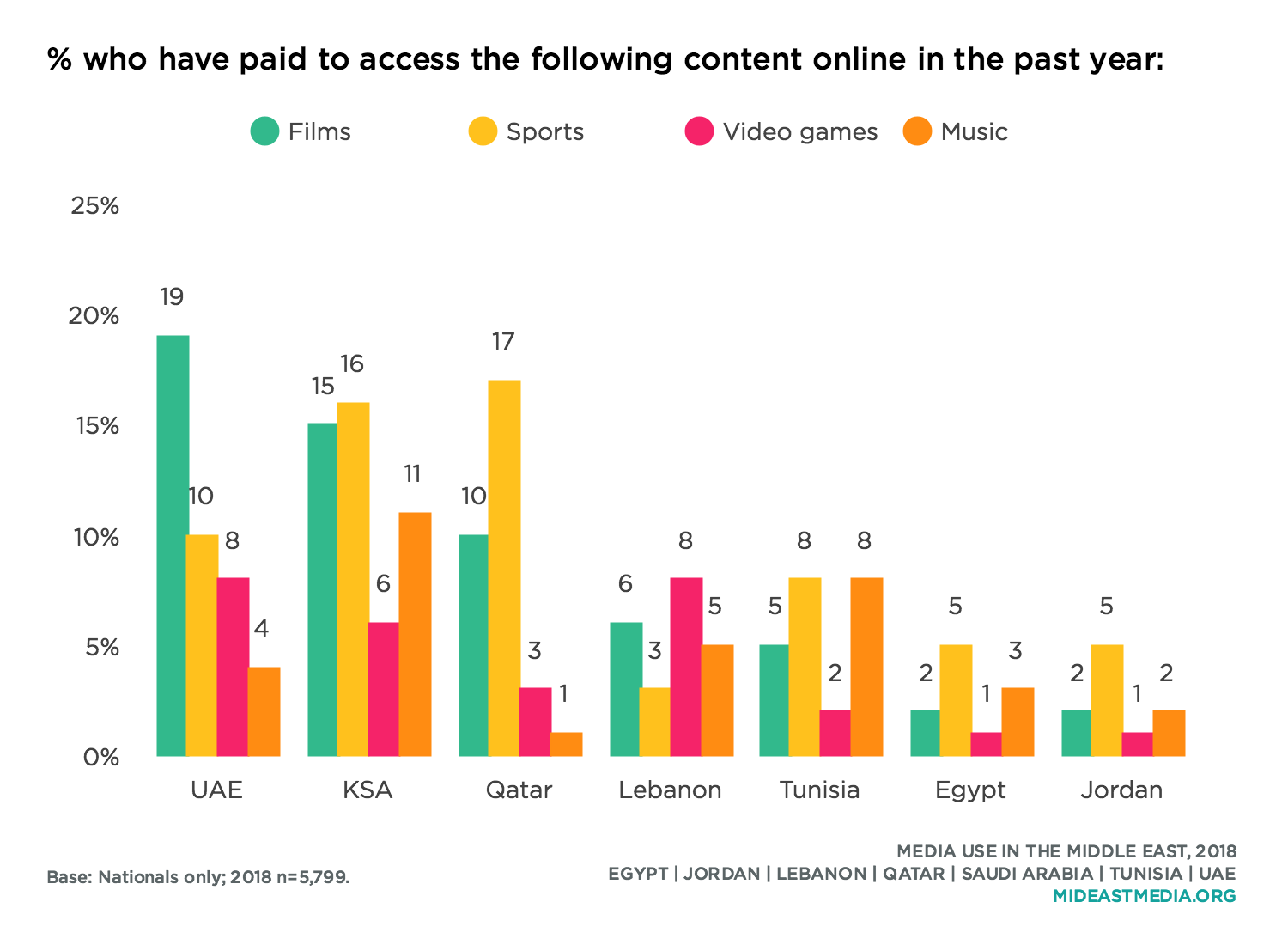

Arab nationals are not inclined to pay to play video games online, and fewer than one in five had paid to access online video games in the previous year. Larger shares of Lebanese and Emiratis than other nationals are open to paying for online games, but only 8% of each of these groups has done so in the past year.

The youngest age cohort—who are more likely to play video games online—are the most likely to have paid to do so in the past year, but still, fewer than one in 10 of this youngest group paid for online access to video games in the prior year (8% 18-24 year-olds, 4% 25-34 year-olds, 2% 35-44 year-olds, 1% 45+ year-olds).

Gaming Goes Mobile

Eric Espig, Northwestern University in Qatar

Over the past year, not only have the demographic data of gamers in the Middle East shifted significantly, but also usage data—how often and how long they play, as well as their motivation to play. The most notable change in gamer user data, however, is found in the increase in the popularity of mobile gaming over console- and PC-based gaming. To understand why this shift to mobile platforms is related to a shift in the demographic data of gamers, it is helpful to look back at some of the milestones of 2018 that were a part of the video game landscape context.

Historically, a majority of survey respondents who identified as gamers has been young and male. In 2018 as in 2014, 4 in 10 Nationals played games on console and PC platforms. However, this year, the overall demographic of gamers across mobile devices has shifted and skewed in the direction of both older and female users. Seventy-five percent of all smartphone users in the Middle East now play games on their personal devices and 25 percent do so every day. In countries where smartphone saturation nears 100 percent such as in UAE and Qatar, a significant number of women and people of all ages are playing games on their phones.=

In a global context, in 2018, the video game industry achieved unprecedented growth in mobile gaming sales. Overall, the video game revenue of 2018 increased by an incredible 12 percent and totaled $137.9 billion. And even more significantly, video games for smartphones have for the first time accounted for over 50 percent of all game sales, grossing $70.3 billion. This means that over half of the market for video game developers has moved out of people’s consoles and PCs, to which games were once relegated, and into people’s pockets and handbags where they are always ready to play while waiting in line or during daily commutes. This demographic data of who plays games, how often and why will continue to shift and has been captured well in the results of this survey of smartphone users.

Video games developed for smartphones are popular among casual gamers, while console based games are predominantly developed for two groups of users. These two groups of primarily console users are commonly known as core and hardcore gamers. They play more often and for more competitive reasons. On the other hand, casual gamers are defined by a non-competitive or completion-based motivation to play. In coming years we will continue to see the rise of casual gamers as more game products are developed for smartphones. These smartphone games are designed to be less competitive, more completion-based and less time intensive, which makes these games more appealing to these casual gamers.

Both the increased popularity of smartphone games and the declining growth of users of console-based games are reflected in the survey results. However, among those console users, we find that Nationals who play video games spent more time doing so in 2018—about 12.4 hours each week—up from 10.5 hours weekly in 2014. This can be explained in part by the massively successful products launched in 2018 for console and PC.

Console games released in late 2017 and early 2018 included many successful and highly anticipated follow-ups to established game franchises, including Grand Theft Auto, Assassin’s Creed, Star Wars Battlefront and Legend of Zelda. Blockbusters such as these likely impacted the amount of time dedicated to console gaming among core and hardcore users. This group is mostly comprised of young men, and nearly 6 in 10 of the youngest nationals surveyed in the Middle East play video games. That number is more than three times the rate of the oldest cohort.

In 2019 and beyond, we should continue to see a rise in the number of casual gamers as more game products that are less competitive and time-intensive are developed for smartphones. But because the motivation to play for the primarily console-based core and hardcore gamers differs from the primarily smartphone-based casual gamers—competition vs. completion-based—we should not expect to see one-to-one growth in both groups. However, as the quality of newly released console-based games remains high—such as the record-smashing Red Dead Redemption 2, which grossed $275 million in its first three days of release in late 2018—the time these core and hardcore gamers spend playing will increase. And as the console-based games these core users traditionally play begin to cross over to the smartphone markets, the distinction between console and smartphone games will decrease and the market growth for games that had traditionally been PC- and console-bound will likely expand, as those games reach more casual gamers on mobile devices.